st louis county sales tax calculator

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

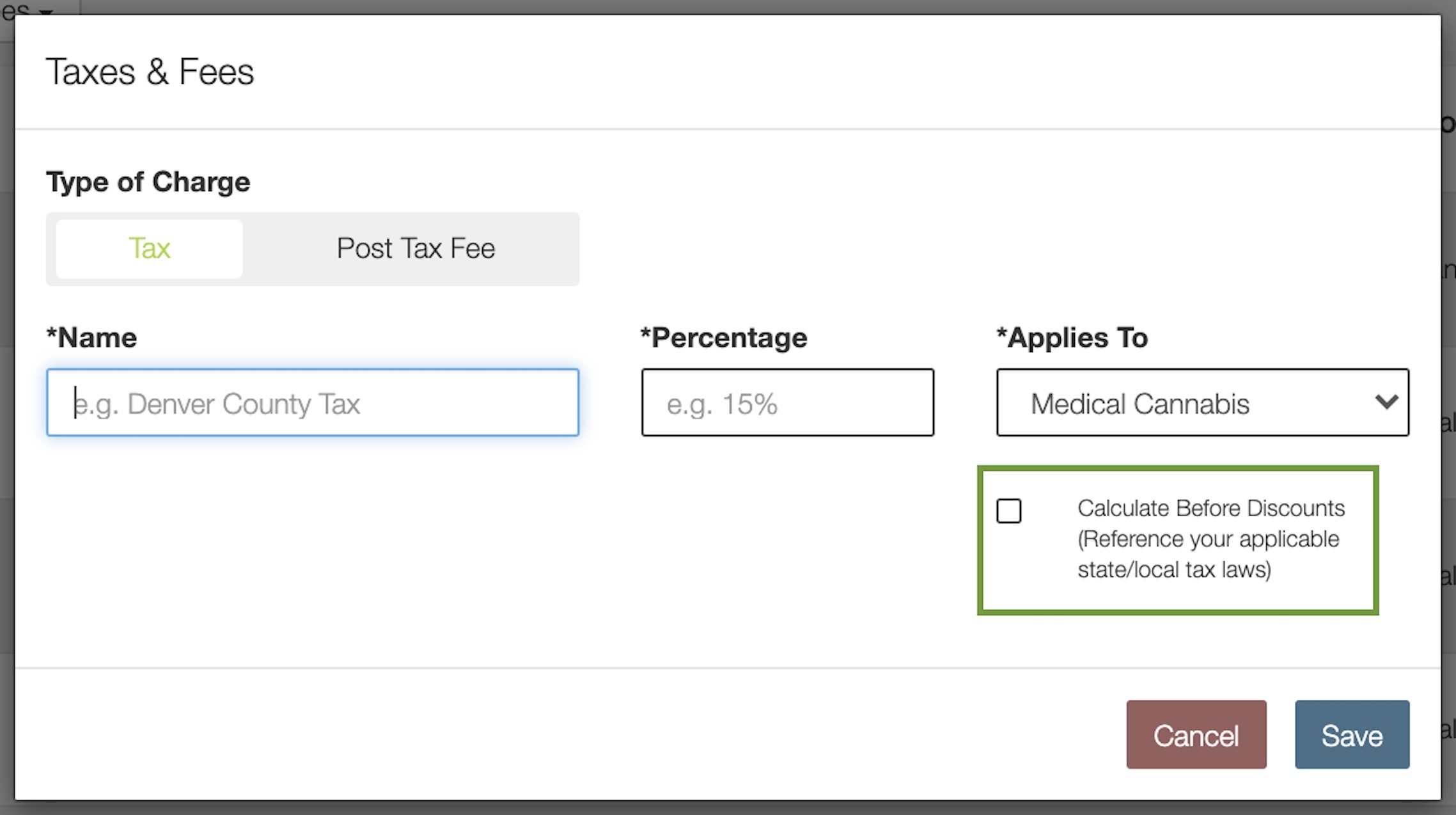

How To Calculate Cannabis Taxes At Your Dispensary

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

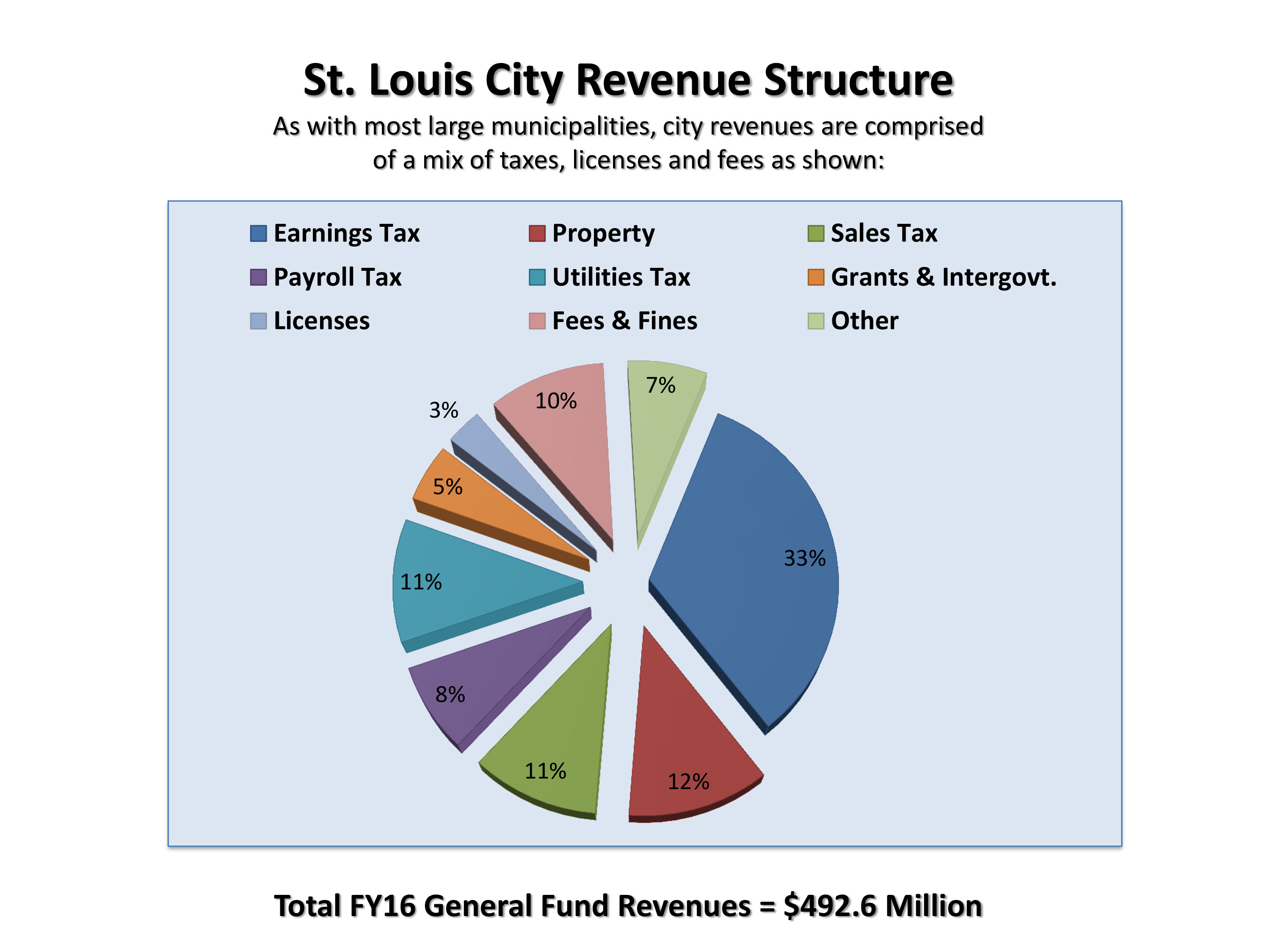

. Sales taxes are another important source of revenue for state and local governments in Missouri. Saint Louis County MO Sales Tax Rate Saint Louis County MO Sales Tax Rate The current total local sales tax rate in Saint Louis County MO is 7738. This includes the rates on the state county city and special levels.

The state sales tax for a vehicle purchase in Missouri is 4225 percent. See all other payment options below for associated. Download all Missouri sales tax rates by zip code The St.

921 Average Sales Tax Summary The average cumulative sales tax rate in Saint Louis Missouri is 921. Their website states You must pay the state sales tax AND any local taxes of the city or county where you. Sales Tax Breakdown Saint Louis.

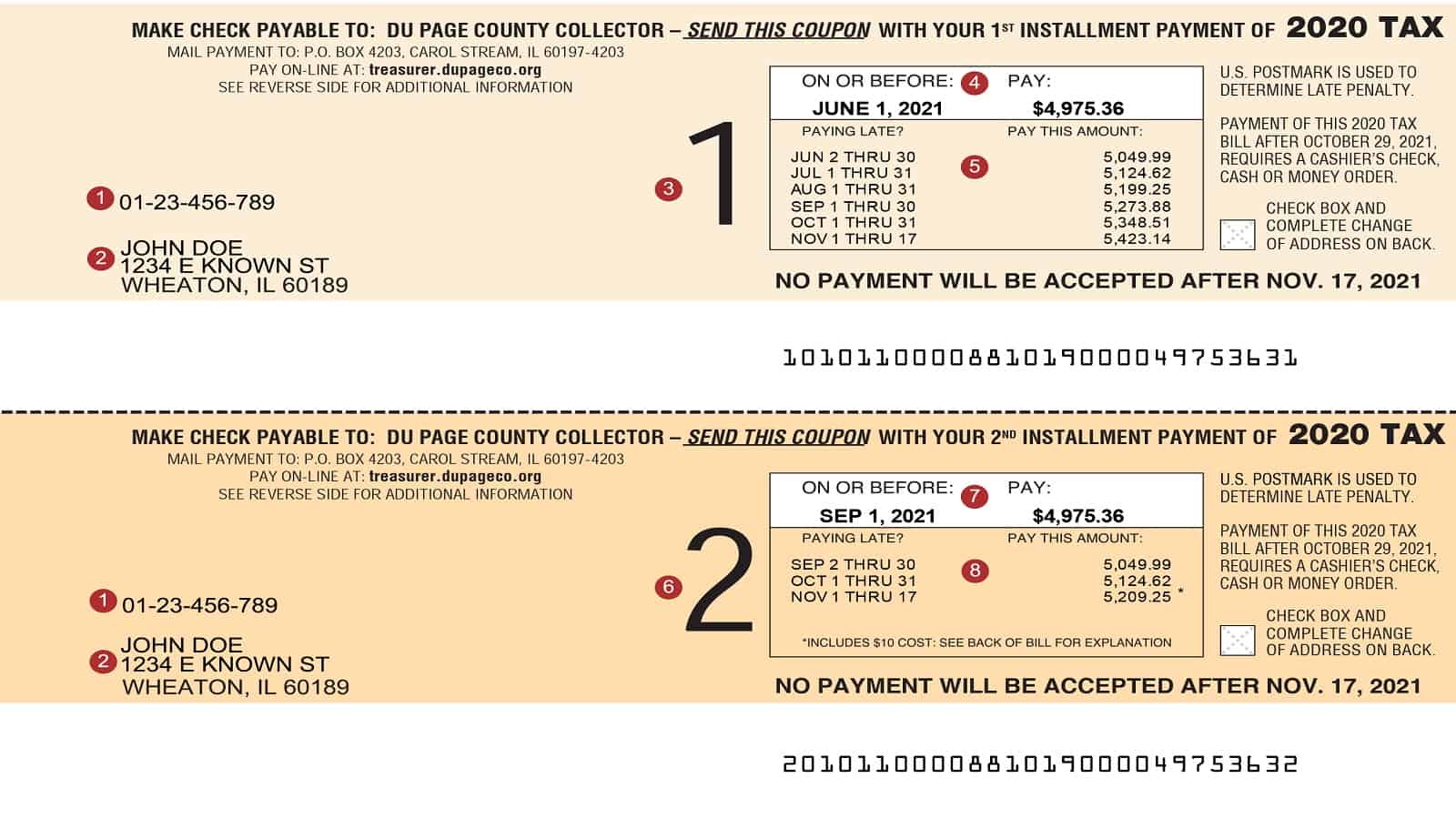

Your payment must be postmarked on or before the due date or penalties will apply. Motor Vehicle Trailer ATV and Watercraft Tax Calculator. Bond Refund or Release Request.

Input the amount and the sales tax rate select whether to include or exclude sales. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Subtract these values if any from the sale price of the unit and enter the net price in the calculator.

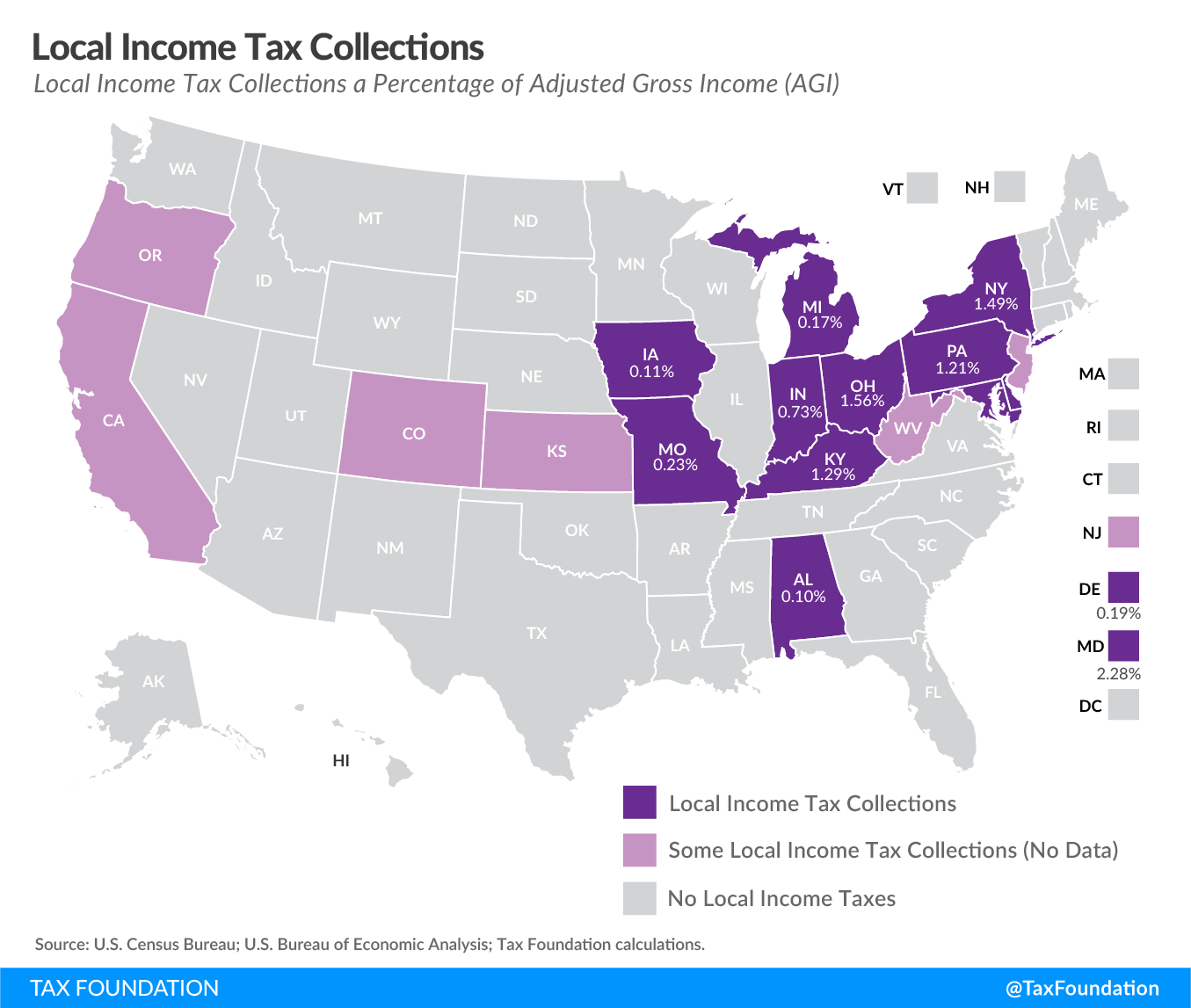

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. The current total local sales tax rate in Saint Louis MO is 9679. Additions to Tax and Interest Calculator.

The December 2020 total local sales. This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

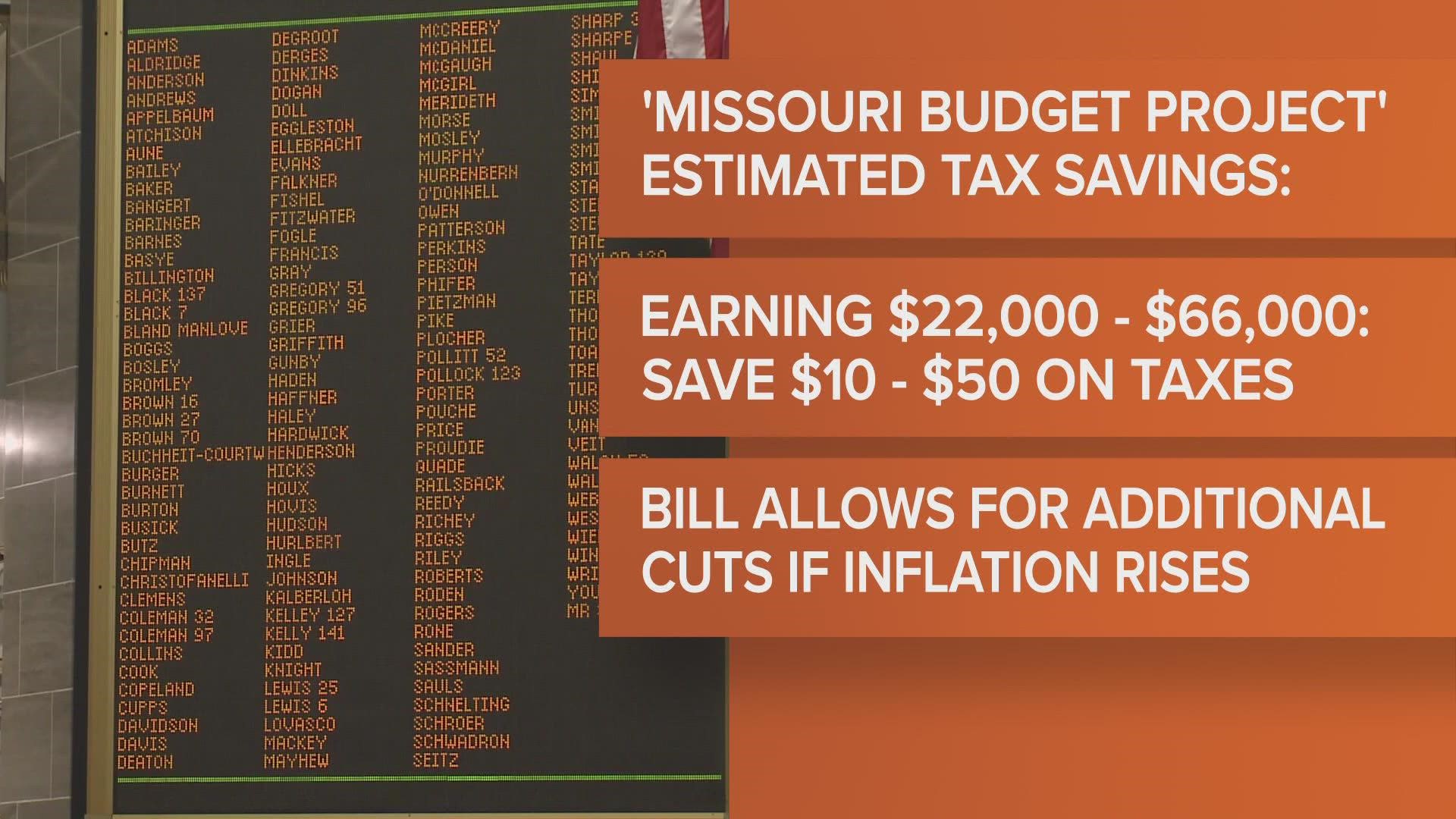

Sales tax in Saint Louis County Missouri is currently 761. The Missouri statewide rate is 4225 which by itself would be. What is the sales tax rate in St Louis County.

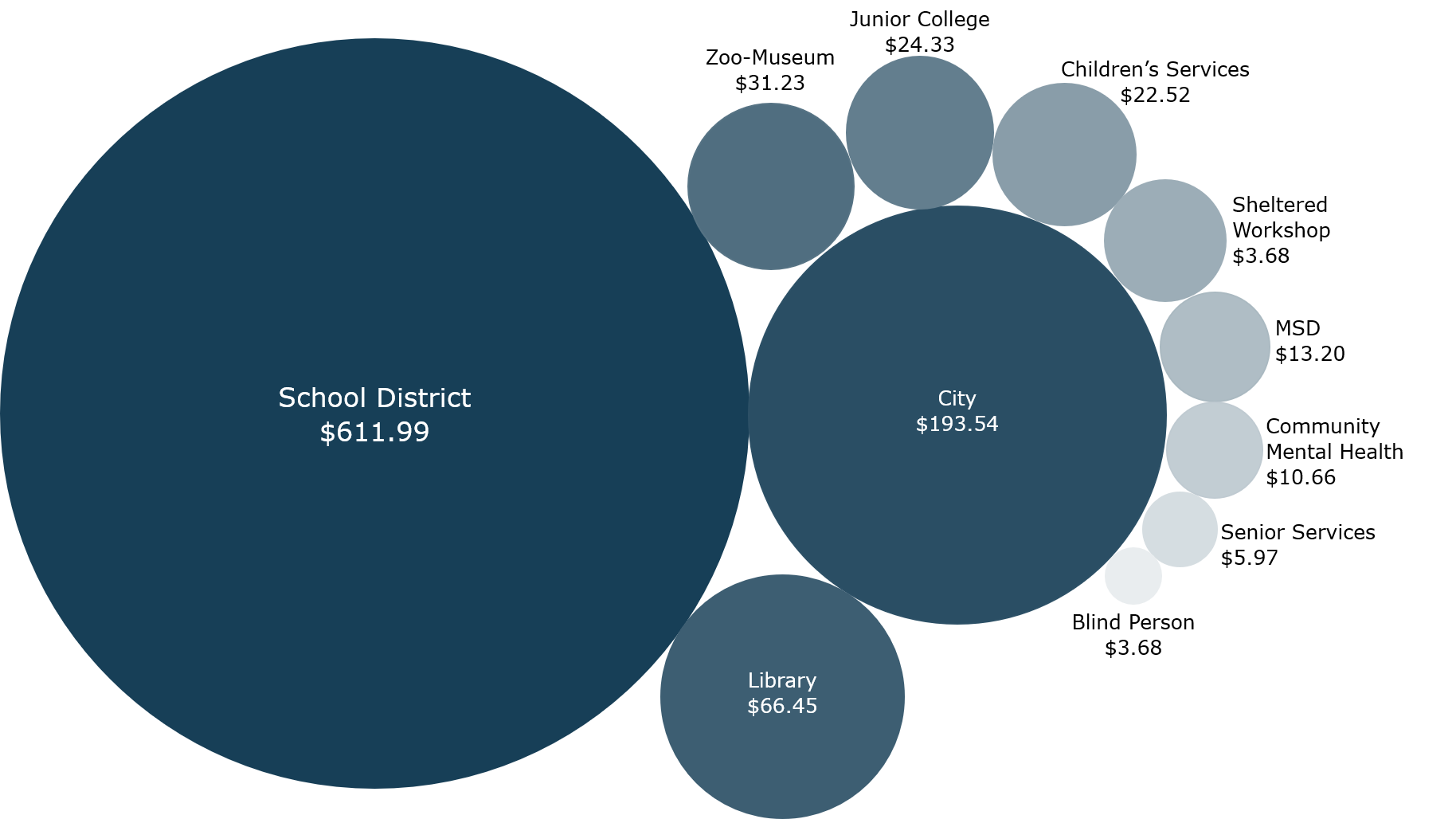

The Missouri DOR is the agency authorized to assess and collect the monies. This is the total of state and county sales tax rates. Provides formulas used to calculate personal property residential real property and commercial real property.

The purchase of a vehicle is also subject to the same potential local taxes mentioned above. The sales tax rate for Saint Louis County was updated for the 2020 tax year this is the current sales tax rate we are. Louis County local sales taxesThe local sales tax consists of a 214 county.

Louis local sales taxesThe local. 11988 sales tax in St Louis County 20945 for a 20000 purchase Roscoe MO 4725 sales tax in St Clair County You can use our Missouri sales tax calculator to determine the applicable. The St Louis County Sales Tax is 2263 A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

The Missouri state sales tax rate is currently. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. Louis County Missouri Sales Tax Calculator Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an.

The December 2020 total local sales tax rate was also 9679. You pay tax on the sale price of the unit less any trade-in or rebate. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. Pay by E-Check for FREE online with Paymentus.

The Non Profit Paradox 40 Of Real Estate In St Louis Is Government Owned Or Tax Exempt Nextstl

Local Income Taxes In 2019 Local Income Tax City County Level

Comptroller Green Supports Earnings Tax

Prop U Tax Information Ellisville Mo Official Website

Missouri Sales Tax Calculator Reverse Sales Dremployee

Los Angeles Rams Move Negatively Affects Players Financially Sports Illustrated

Is Food Taxable In Missouri Taxjar

City Versus County Tax Sales Your St Louis Missouri Guide Tdd Attorneys At Law Llc

Sales Tax Calculator And Rate Lookup Tool Avalara

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

St Louis U S Small Business Administration

Property Tax By County Property Tax Calculator Rethority

This Cannot Continue Much Longer St Louis County Faces Growing Budget Deficit